Corporate Governance

Basic Policy

Guided by our Corporate Philosophy, Kaneka aims to achieve sustainable growth, improve medium- to long-term corporate value, and build trust among all stakeholders, including shareholders, investors, customers, local communities, vendors, and employees, realizing optimum corporate governance to fulfill our social responsibility.

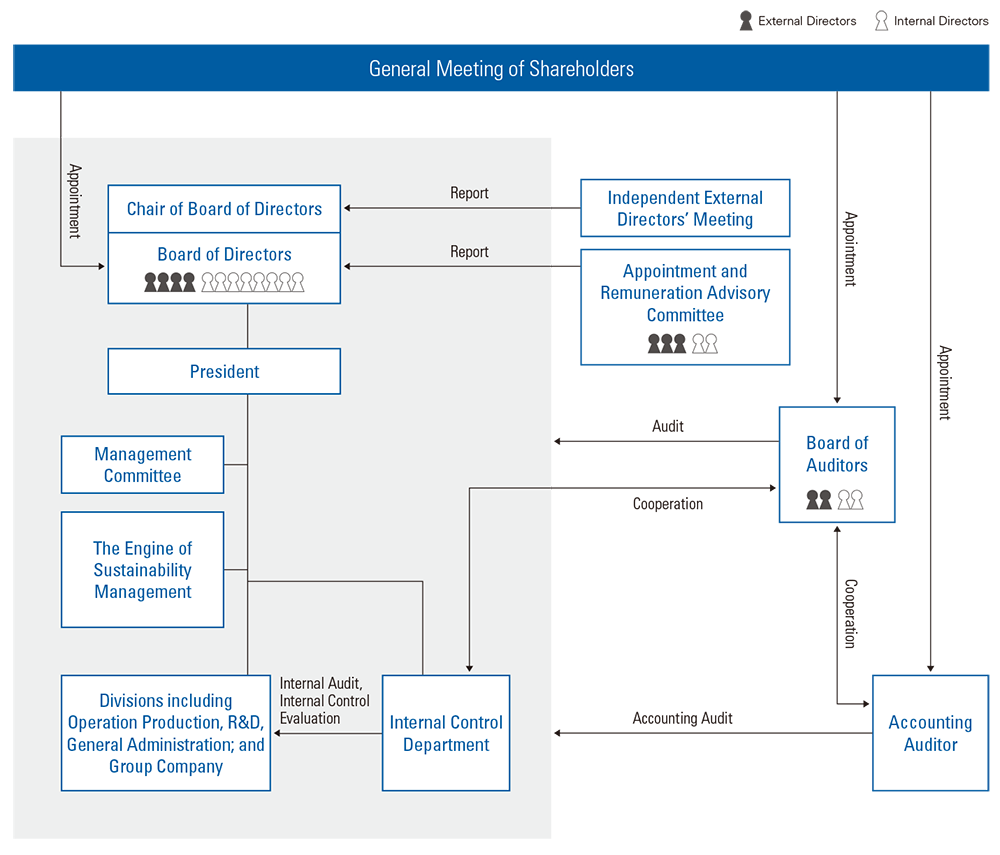

Diagram of Corporate Governance System (June 29, 2022)

We reorganized our ESG-related organization on April 1, 2022, establishing the Engine of Sustainability Management, which is tasked with overseeing and enhancing ESG management.

We also changed the name of the Internal Control Division of the ESG Department to the Internal Control Department.

Corporate Governance Structure

Organizational Design

We currently have four independent external directors and two independent external auditors. Since both the overseeing of business operations by the Board of Directors and auditing by the Board of Auditors are functioning well, Kaneka has chosen to be a Company with Board of Auditors under the Companies Act.

Directors and the Board of Directors

The Board of Directors seeks to ensure efficient and effective corporate governance in order to realize the company’s sustainable growth and increase corporate value in the medium to long term.

The Board of Directors exercises its oversight functions on overall management to ensure fairness and transparency, as well as to appoint management positions, evaluate and determine remuneration, evaluate serious risks and determine strategies to counter them, and make the best decisions on important business operations. The Board of Directors makes resolutions on important matters related to the management of the Kaneka Group after deliberation by the Management Committee, which includes the president. There are at most 13 members on the Board of Directors. Of these, four are independent external directors, in principle, to strengthen the oversight function. Directors serve for a period of one year to clearly define management responsibilities.

Auditors and the Board of Auditors

Auditors and the Board of Auditors seek to ensure healthy and sustainable corporate growth and to establish a structure with good corporate governance that can gain social trust by checking on the performance of directors in regard to their duties.

The Board of Auditors comprises four members, two of whom are independent external auditors in principle, and performs audits in coordination with the Accounting Auditor and the Internal Control Department. Auditors are given space to periodically exchange views with the president, and monitor the state of business operations when necessary, by attending key meetings of the Board of Directors and those of the Management Committee, which decides on the implementation of important matters, as well as division head meetings.

Appointment and Remuneration Advisory Committee / Independent External Directors’ Meeting

We have established the Appointment and Remuneration Advisory Committee and Independent External Directors’ Meeting. The Appointment and Remuneration Advisory Committee discusses remuneration of Directors, and candidates for Directors and Audit & Supervisory Board Members, and reports them to the Board of Directors. The Independent External Directors’ Meeting discusses the effectiveness of the Board of Directors to report to the Chair of the Board of Directors. In order to increase neutrality, the majority of the Appointment and Remuneration Advisory Committee are the independent external directors.

Implementation of Business Operations

Kaneka has adopted the executive officer system to harmonize the oversight function of directors with the implementation function of business operations, which also facilitates decision-making and clearly defines roles. The Board of Directors decides on key management strategies and business operations of the entire Kaneka Group, while executive officers handle business operations in their respective areas of responsibility. The Executive Officers’ Meeting is held monthly to share management policies and issues with the aim of achieving management goals speedily. Division heads, including executive officers appointed by the Board of Directors, are given extensive authority over daily business execution. Monthly division head meetings are held to enable the directors and auditors to directly hear progress reports from each division head. The Internal Control Department evaluates the effectiveness of internal control and conducts an internal audit.

Selection Criteria for Directors

At Kaneka, directors are selected by the Board of Directors, on the basis of character, judgment, expertise and experience as well as ethics, after deliberation by the Appointment and Remuneration Advisory Committee, which is comprised of directors and independent external directors.

We are expanding diverse businesses globally. In order for the Board of Directors to make accurate and prompt decisions and supervise these corporate activities, we place great importance on appointing directors with different backgrounds such as diverse knowledge, experience, and expertise. Specifically, we expect knowledge, experience, and abilities related to business, global, technology, and corporate and governance. We also believe that the Board of Directors as a whole has a well-balanced knowledge, experience, and abilities, and is composed of an appropriate number of people.

In selecting directors, no restrictions are made in terms of gender, age or nationality.

A skill matrix covering each director is disclosed in the Notice of the Annual General Meeting of Shareholders.

Analysis and Evaluation of Effectiveness of the Board of Directors

Kaneka regularly implements an analysis and evaluation of the effectiveness of the Board of Directors, and discloses a summary of the evaluation results. Specifically, the Chair of Board of Directors periodically receives reports from the Independent External Directors’ Meeting and opinions from the internal directors.

Based on these reports, the current status of operations of the Board is evaluated. In the evaluation process in fiscal 2021, the Independent External Directors’ Meeting held discussions focusing on the operation of the Board of Directors (number of meetings held, frequency, length, contents of information provided beforehand, contents of agendas, deliberations, etc.), role of external directors, information provision to external directors, and risk management. Based on the discussion results, the Board of Directors conducted a self-evaluation. As a result, it has been confirmed that the Board of Directors functions effectively in making decisions on important matters for the Group such as risk management and supervising business execution. We will continue to enhance the effectiveness of our Board of Directors through effectiveness evaluations.

Our Efforts to Strengthen the Governance Capacity

| 2006 |

|

|---|---|

| 2011 |

|

| 2013 |

|

| 2015 |

|

| 2016 |

|

| 2019 |

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

Standards for Independence of External Directors/Audit & Supervisory Board Members

We have defined the Standards for Independence of External Directors/Audit & Supervisory Board Members to guarantee the independence of independent external directors and auditors in practice.

The standards are disclosed in our notice of convocation of general meeting of shareholders, corporate governance report, etc.